Deep Yellow again defers Tumas investment decision citing market conditions

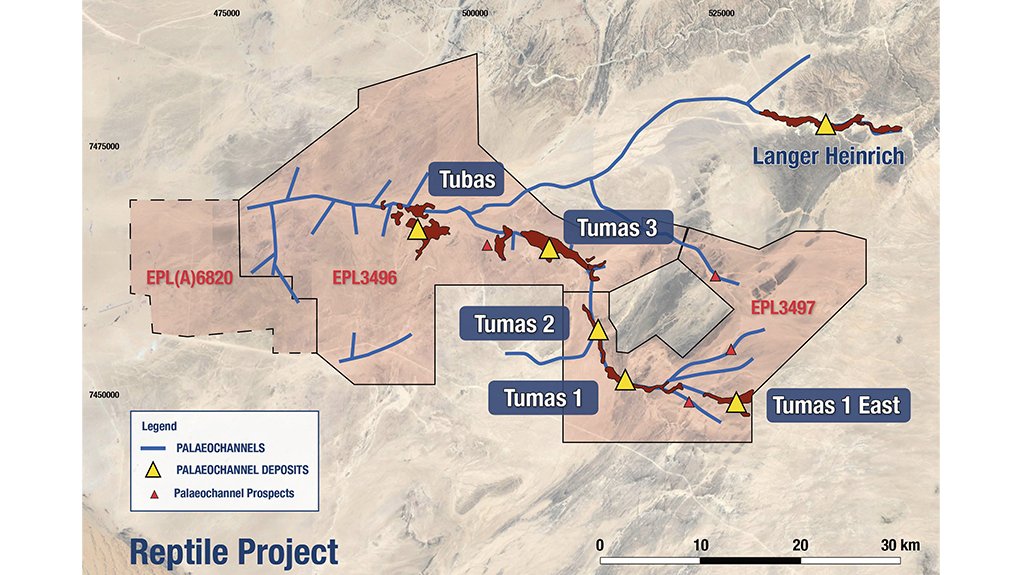

Australia-listed Deep Yellow has deferred the final investment decision (FID) for its flagship Tumas project, in Namibia, to fully capitalise on its upside potential and to protect shareholder value, as the uranium market does not currently support this.

As previously reported, the company earlier this year deferred the FID to March following delays in receiving final costing and quotes for detailed engineering work.

Additional detailed engineering conducted in the past three months confirmed Tumas as a robust, long-life project. However, as previously stated, a key element to delivering FID would always be the prevailing uranium market conditions that would justify development of a greenfield uranium project.

The board has elected to provide staged approval for the project and is delaying construction of the processing plant, which involves the majority of estimated capital expenditure.

Deep Yellow will continue to move ahead with early works infrastructure development and detailed engineering; however, full-scale project development will be delayed allowing for what the board believes will be the inevitable improvements in global uranium prices owing to increasing demand and the precarious nature of the supply outlook.

“We are at an extraordinary stage in the uranium supply sector. We have a situation where the long-term uranium market is essentially broken. This is due to more than a decade of sector inactivity, persistently depressed uranium prices and utility offtake contracting practices which are yet to support the development of greenfield uranium production,” Deep Yellow MD John Borshoff explains.

Although the Tumas project is economic at current long-term uranium prices, these prices do not reflect or support the considerable amount of production that needs to be brought online to meet expected demand, he states.

Moreover, the company expects supply shortages will only be exacerbated by likely delays and underperformance of the sector generally.

“Deep Yellow is in an enviable position having one of the most rigorously evaluated greenfield projects in the world ready to hit the ‘go’ button. The extended detailed engineering and associated studies that have been completed provide even greater confidence of what can be delivered and how,” Borshoff highlights.

Water and power supply agreements have been completed as the company proceeds with the off-site infrastructure needs, and project financing is proceeding well, he informs.

“Combine this with the strong stewardship offered by our fully proven technical teams and leadership, unique to the sector of emerging producers, and it is clear we have all the ingredients and capability to move ahead positively when justified,” Borshoff avers.

“The Tumas project is ready to take the next step but, as we have consistently stated, a healthy prevailing uranium market is a key prerequisite. The final project approval will, therefore, be delayed until uranium prices fully reflect a sustainable incentivisation environment essential to encourage development of new projects for much needed additional production,” he emphasises.

“This is a deliberate strategic decision reflecting the company’s experience-based approach to sustainable uranium production aimed entirely at preserving the company’s precious resources and reserves to achieve better value for Deep Yellow and its shareholders and facilitate continued growth.

“We believe our shareholders are patient and would prefer that we maximise value rather than rush to market. We will continue to derisk the project through a staged development approach,” Borshoff says.

Comments

Announcements

What's On

Subscribe to improve your user experience...

Option 1 (equivalent of R125 a month):

Receive a weekly copy of Creamer Media's Engineering News & Mining Weekly magazine

(print copy for those in South Africa and e-magazine for those outside of South Africa)

Receive daily email newsletters

Access to full search results

Access archive of magazine back copies

Access to Projects in Progress

Access to ONE Research Report of your choice in PDF format

Option 2 (equivalent of R375 a month):

All benefits from Option 1

PLUS

Access to Creamer Media's Research Channel Africa for ALL Research Reports, in PDF format, on various industrial and mining sectors

including Electricity; Water; Energy Transition; Hydrogen; Roads, Rail and Ports; Coal; Gold; Platinum; Battery Metals; etc.

Already a subscriber?

Forgotten your password?

Receive weekly copy of Creamer Media's Engineering News & Mining Weekly magazine (print copy for those in South Africa and e-magazine for those outside of South Africa)

➕

Recieve daily email newsletters

➕

Access to full search results

➕

Access archive of magazine back copies

➕

Access to Projects in Progress

➕

Access to ONE Research Report of your choice in PDF format

RESEARCH CHANNEL AFRICA

R4500 (equivalent of R375 a month)

SUBSCRIBEAll benefits from Option 1

➕

Access to Creamer Media's Research Channel Africa for ALL Research Reports on various industrial and mining sectors, in PDF format, including on:

Electricity

➕

Water

➕

Energy Transition

➕

Hydrogen

➕

Roads, Rail and Ports

➕

Coal

➕

Gold

➕

Platinum

➕

Battery Metals

➕

etc.

Receive all benefits from Option 1 or Option 2 delivered to numerous people at your company

➕

Multiple User names and Passwords for simultaneous log-ins

➕

Intranet integration access to all in your organisation